defer capital gains tax stocks

Hold Your Stocks In A Qualified Retirement Account Buying and holding dividend stocks for qualified retirement. In what can only be described as a bad move for the capital market the Jubilee administration recently reintroduced Capital Gains Tax CGT which will come into effect in.

It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales.

. Well if you hold your stock for longer than a year then sell it at a profit you would be taxed at the more favorable rate of 15 though it can be as high as 20 if you have a very. Move to a tax-friendly state. Utilizing losses is the least attractive of all the.

Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

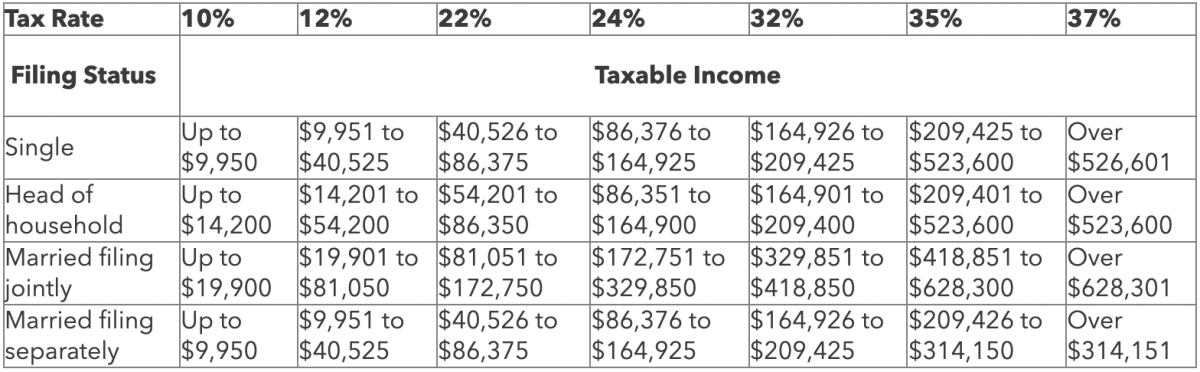

Capital gains deferral B x D E. For taxpayers in either the 10 percent or 12 percent income tax brackets their long-term capital gains rate is 0 percent. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be.

Luckily the tax laws provide for several ways to defer or even completely avoid paying taxes on your securities sales. Read this guide to learn ways to avoid running out of money in retirement. Those taxes could run as high.

Urban Catalyst is a leading Opportunity Zone Fund in Silicon Valley. Capital Gains Tax on Stocks. The 1031 Exchange is the holy grail of tax deferral opportunities.

These capital gains defer taxation until the end of 2026 or whenever the asset is disposed of whichever is first. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. If certain conditions are met investing your capital gain in a Qualified Opportunity Zone QOZ by December 31st 2021 can DEFER your federal and at times state.

The top left chart reminds us that if the capital gains tax rate remains unchanged at 238 deferring built-in gains results in a higher post-liquidation wealth at any investment. Starting with 4 ways to eliminate capital gains taxes on stocks. Ad Were all about helping you get more from your money.

Lets get started today. What You Need to Know Our Services Investing Basics Premium Services Stock Advisor Our Flagship Service Return 372 SP Return 122. Second capital gains placed in Opportunity Funds for a.

Ad Trade SP 500 Index options with a 100 multiplier SPX or a 10 multiplier XSP. The 10 Percent to 15 Percent Tax Bracket. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

5 ways to avoid paying Capital Gains Tax when you sell your stock Stay in a lower tax bracket. Ad If youre one of the millions of Americans who invested in stocks. Urban Catalyst is a leading Opportunity Zone Fund in Silicon Valley.

The permitted deferral of the capital gain from the disposition of eligible small business corporation shares is determined by the following formula. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Strategies For Investments With Big Embedded Capital Gains

How To Reduce Capital Gains Tax On Stocks

Strategies For Investments With Big Embedded Capital Gains

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

Tax Deferral How Do Tax Deferred Products Work

What Is The Benefit Of Tax Deferred Growth Great American Insurance

The Capital Gains Tax And Inflation Econofact

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Restricted Stock Units Jane Financial

Strategies For Investments With Big Embedded Capital Gains

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)